Financing the Water Sector – An Alternate Approach

By Kavita Sachwani*

Water – the universal solvent

With a strong causal relationship between water security and economic growth already evident, investments in the water sector are key for sustainable development and inclusive growth, leading to the realisation of multiple SDGs, including those on food security, health, and clean energy. Water-related investments address a multitude of inter-related needs viz., irrigation for food security, providing drinking water and sanitation services, and reducing pollution by promoting wastewater treatment services. In the emerging spectre of climate change, water has moved centre-stage as improving its efficient use as a resource holds promise for sustaining farm-based rural economy towards bringing about urban stability. Given that there is either too little water, too much water, or too polluted water, lack of investment at the desired level hampers water security.

Investment in water security

Large, long-term investments are required in resilient water infrastructure, climate-smart agricultural systems, improved drainage, nature-based flood protection, etc. Stringent regulations around water quality and the need to promote a circular economy are forcing water users across sectors to invest in newer cutting-edge technologies to meet these standards. For example: (i) emerging contaminants are accumulating in water and require innovative technologies for efficient removal, (ii) digitization is rapidly penetrating the water industry (such as smart real-time sensors, AI, ML, smart metering, leak detection, satellite imaging, large efficiency gains, and increased water security), and (iii) water infrastructure around the world is ageing and so require replacement coupled with incorporating new technologies to increase efficiency.

The financing gap

However, there is a big financing gap that exists between investments required and current investments flowing in these key areas. The UN estimates the gap in financing to achieve the SDGs at USD 2.5 trillion per year in developing countries alone.[1] For irrigation, the FAO estimates that some USD 960 billion will be required between 2005/07 and 2050 to ensure water for agricultural production in 93 developing countries (Koohafkan et al. 2011). For water supply and sanitation, an estimated USD 1.7 trillion will be needed (Hutton and Varughese 2016). Failure to address investment in the water sector could diminish growth rates by as much as 6 percent of GDP by 2050.[2]

Aligning the financial case for water with the social, environmental, and economic case for water

The economic argument for water is often weak on account of its public good nature and the tragedy of the commons, leading to a disregard for sustainability. Even where investment in water security makes economic sense, the economic argument has not translated into a compelling financial case for investment, and water continues to be an under-valued and underpriced resource. Aligning the financial case for water with the economic case for water towards bridging the investment gap requires a multi-stakeholder financing approach towards maximizing finance for development and systematically leveraging all sources of finance, expertise, and solutions to support developing countries’ sustainable growth. This can be done by improving the enabling environment, developing regulatory conditions, building capacity, putting in place standards financing a first mover or innovator, and reducing risks.

Alternative financing for the water sector

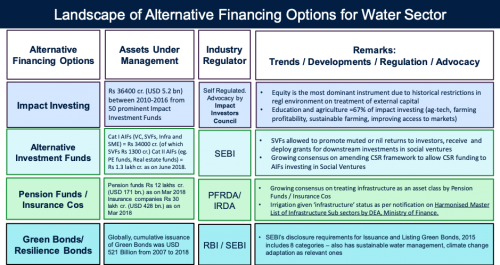

Investments in innovative approaches to finance water security require appropriation of inter-institutional spaces to mobilize resources going beyond traditional financing and subsidy-driven models. The following Alternative Financing avenues can be explored through structures and products that reorient markets and investors away from short-termism and encourage greater sustainability in performance, while also developing domestic capital markets.

(1) Blended Finance

Blended finance is a structuring approach using “catalytic capital from public and philanthropic sources to increase private sector investment in sustainable development.”[3] Catalytic capital bears higher risk and/or seeks lower returns than the market would accept. This framing distinguishes finance by purpose rather than by source and highlights it in terms of development and commercial finance, rather than public and private actors. Blended finance transactions have three signature markings – (1) Development impact & SDGs: Contribute towards achieving the SDGs, (2) Return: Expected positive financial return, and (3) Leverage: Philanthropic parties are catalytic – improve the risk-return profile to mobilize/attract “additional” private sector investment.

(2) Impact bonds

Impact investing is replacing the approach to investing from one based on risk and return, to risk, return, and impact; and seeks to create social or environmental benefits, directing capital to enterprises that accomplish impact goals that traditional business models cannot. In impact investing, social and environmental considerations are not lenses for rejection of opportunities; they are front and centre in the decision-making criteria for investors. Impact bonds monetize social/development outcomes by capturing the value between the cost of prevention now and the price of remediation in the future. Outcome payers in case of DIBs are generally DFIs / private sector, who pay the upfront funders / risk investors of the project along with returns based on the outcome of the project. In SIBs, the Government is the outcome payer.

(3) Pension funds

There is growing consensus among institutional investors including pension funds, on infrastructure as an asset class, and these investors are participating in the financing, building, and operating of infrastructure through PPPs. Investments in infrastructure[4] are characterised by long-term contractual arrangements and regulation, and a means to reduce portfolio risks through diversification and to access higher risk-adjusted returns.

(4) Green bonds

Green bonds are fixed-income financial instruments, where the proceeds are earmarked for financing green projects with a potential to attract capital that can generate a positive investment cycle for green projects. In India, SEBI has introduced certain guidelines for green bonds[5] and has allocated 8 high-level categories as “green projects”: renewable energy, clean transportation, sustainable water management, climate-change adaptation, energy efficiency, sustainable waste management, sustainable land use, and biodiversity conservation. (i) Agriculture – Under the SEBI guidelines, organic farming, Zero Budget Natural Farming (ZBNF), and sustainable irrigation practices come under sustainable land use and sustainable water management. Some capital intensive technologies such as drip irrigation can be linked with Green Bonds to fast track fund-raising[6]. (ii) Water Infrastructure and Management – The RBI has recognised the need for funds in this sector, at both household and enterprise levels. WASH (water, sanitation, and hygiene) has been included in priority-sector lending.

The need to change the way we “treat” water

Tapping into these alternative sources has the potential to create a transformation in financing the water sector, but that in turn requires a transformation in the way we “treat” water. As an ecosystem, we need to move from “hunting for water to cultivation of water” and from “pricing water to valuing water,” and we need to look at “water not just as a sector, but a connector” on which human survival and well-being depends. Water is virtually the docking station for all SDGs, and removing water from the equation would render all our efforts in moving the needle on other SDGs useless.

[1] UNCTAD 2014

[2] World Bank Report on Financing the 2030 Water Agenda December 2016 and World Bank report High and Dry: Climate Change, Water and the Economy

[3] According to global group Convergence

[4] Irrigation Infra, STPs are given ‘infrastructure’ status per notification on Harmonised Master List of Infrastructure subsectors by DEA, Ministry of Finance.

[5] Securities and Exchange Board of India, Disclosure Requirements for Issuance and Listing Green Bonds, 2015

[6]Kumar, Neha; Vaze, Prasant; Kidney, Sean, Moving from Growth to Development: Financing Green Investment in India, ORF Special Report, April 2019

* Kavita Sachwani is a Chartered Accountant by qualification and a public policy and development sector professional and works with the 2030 Water Resources Group, World Bank.