Scaling Up Finance for Water: A WBG Strategic Framework and Roadmap for Action

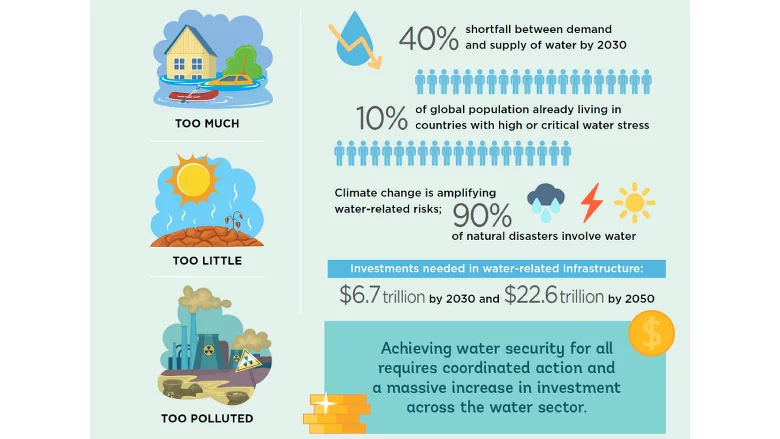

Water—and the related crises brought about by climate change—is one of the most urgent challenges the world faces today. A few facts to illustrate this:

- More than 2.3 billion people lack access to safe drinking water and 3.6 billion people lack access to sanitation, with implications for health, education, and human capital development.

- Nine out of 10 natural disasters are water-related.

- By 2050, flood and droughts could cause $5.6 trillion in cumulative losses to the global economy.

Prioritizing and protecting this precious resource and securing sustainable access to various water services for communities and economies is urgent, yet action is not being taken at the scale and with the urgency needed.

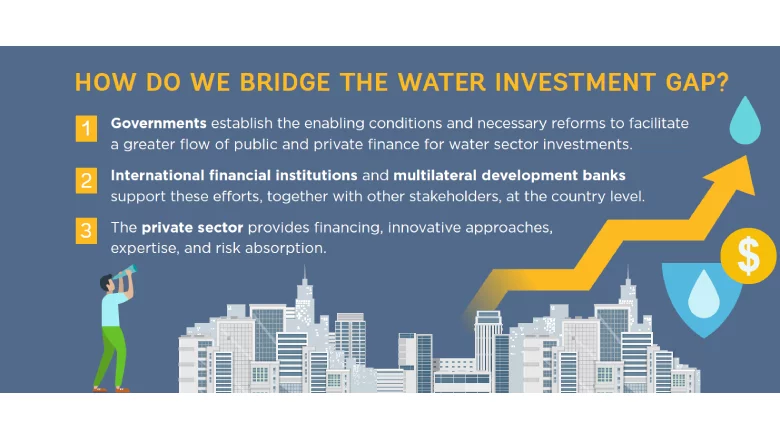

As largely proven, water resources are under severe stress and water services delivery is deficient on account of underinvestment in the sector. In this scenario, closing the investment gap is essential. The private sector has a key role to play in bridging the financing gap and helping to achieve the water-related Sustainable Development Goals.

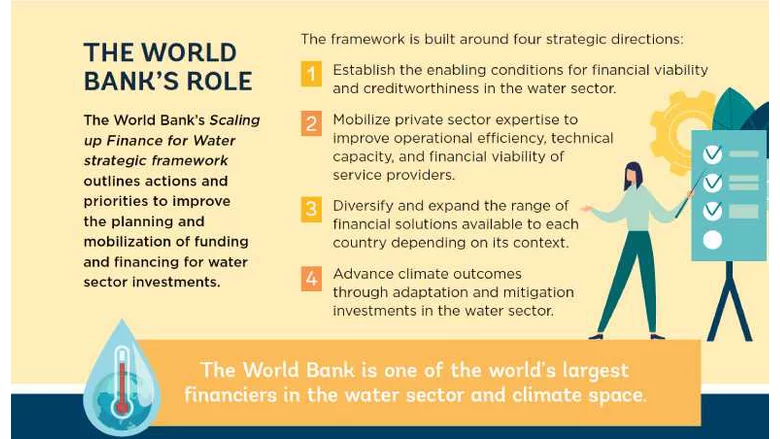

The World Bank’s vision is to create a world free of poverty on a livable planet, supporting impactful development that is inclusive, resilient, and sustainable, including through access to clean water.

With this goal in mind, different parts of the World Bank, including the International Bank for Reconstruction and Development (IBRD), the International Development Association (IDA), the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA), and 2030 Water Resources Group (2030 WRG), a public-private collaboration platform, have committed themselves to scaling up finance for water-related investments in emerging and developing economies, focusing specifically on crowding additional private sector innovation, expertise, and capital into a sector that has been historically funded through public and concessional financing in most of the developing world.

The resulting strategic framework is presented in the Scaling Up Finance for Water publication which is the first concerted effort by the World Bank (including IBRD, IDA, IFC, and MIGA) to jointly engage on programmatic- and project-level opportunities in the water sector, with the aim of unlocking private sector expertise, innovation, and capital.

The framework provides a set of strategic directions and a customizable roadmap for the public sector, private sector, international organizations, intermediaries, and others to collaborate towards catalyzing greater financing and innovation for the water sector. This builds on the collective experience and knowledge of the World Bank and development partners on addressing the barriers to mobilizing additional resources in the sector.

The framework focuses on these priorities:

Creating the enabling conditions for scaling up finance through reforms and regulations, sector restructuring, capacity building, and incentives.

Mobilizing private sector participation through concessions, BOTs (Build-Operate-Transfer), performance based contracts, and other instruments to improve operational efficiency and financial viability.

Diversifying and expanding the range of financial solutions available to each country depending on its context, covering commercial debt, bonds, microfinance, public-private partnerships, and equity instruments.

Advancing climate action through water projects that help build resilience and adapt to and mitigate the effects of climate change.

To create a sustainable and resilient water sector with enough capital for the future, it is important to learn from the past, strengthen the capacity of governments and water service providers, create an enabling environment for water sector investments, develop a pipeline of bankable projects, mobilize water investments using the full range of financing solutions available, with a focus on local currency and domestic finance, and bring various stakeholders together at the country level around common principles to coordinate action and financing in the sector.